Freak Athlete + Truemed

We believe that movement is medicine, and our partners at Truemed agree. Thanks to our collaboration, eligible customers can now use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds to purchase products like the Hyper Pro!

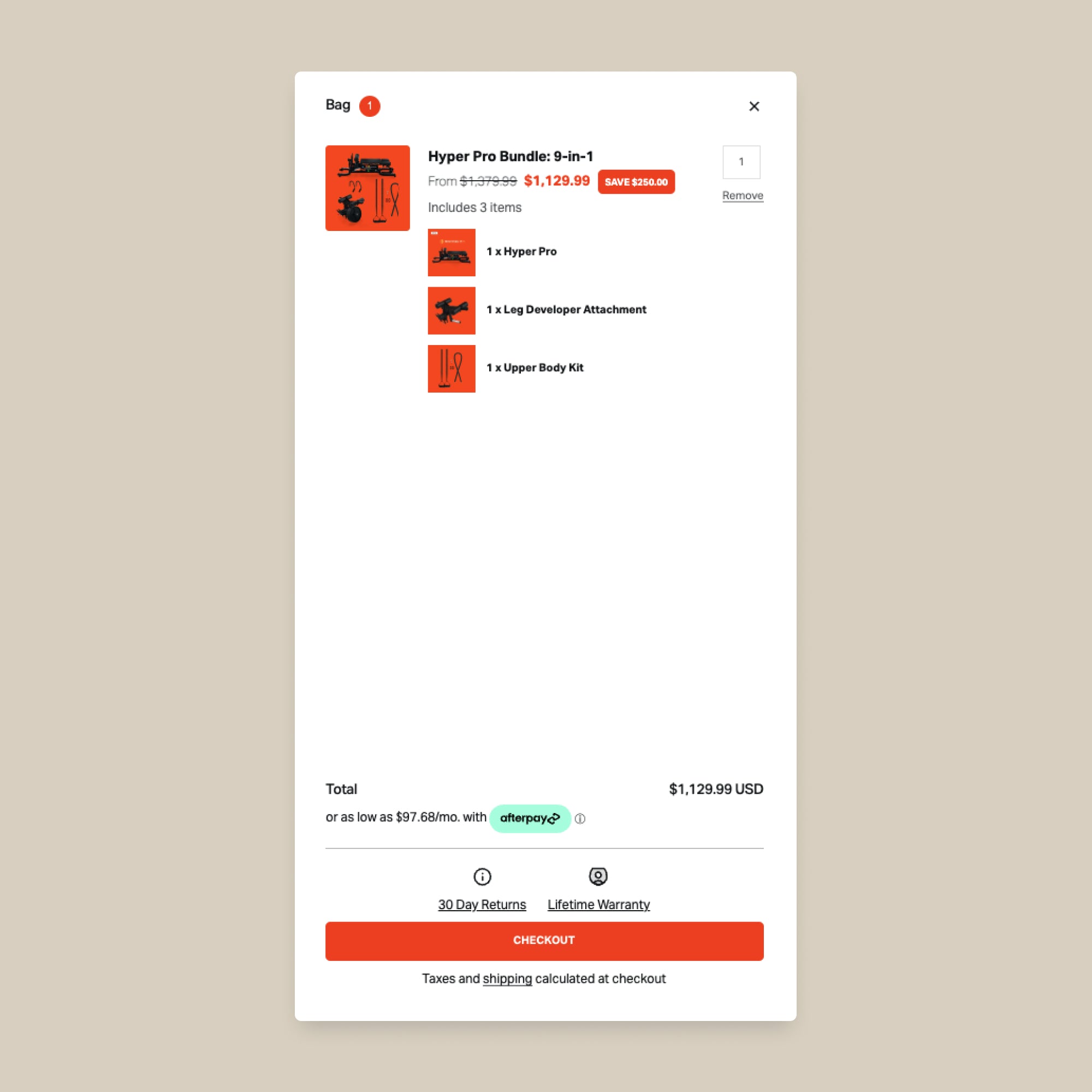

Add products to cart

Start by selecting your desired products and adding them to your cart. Once you're ready, proceed to checkout and enter your personal details to complete your purchase.

STEP 1

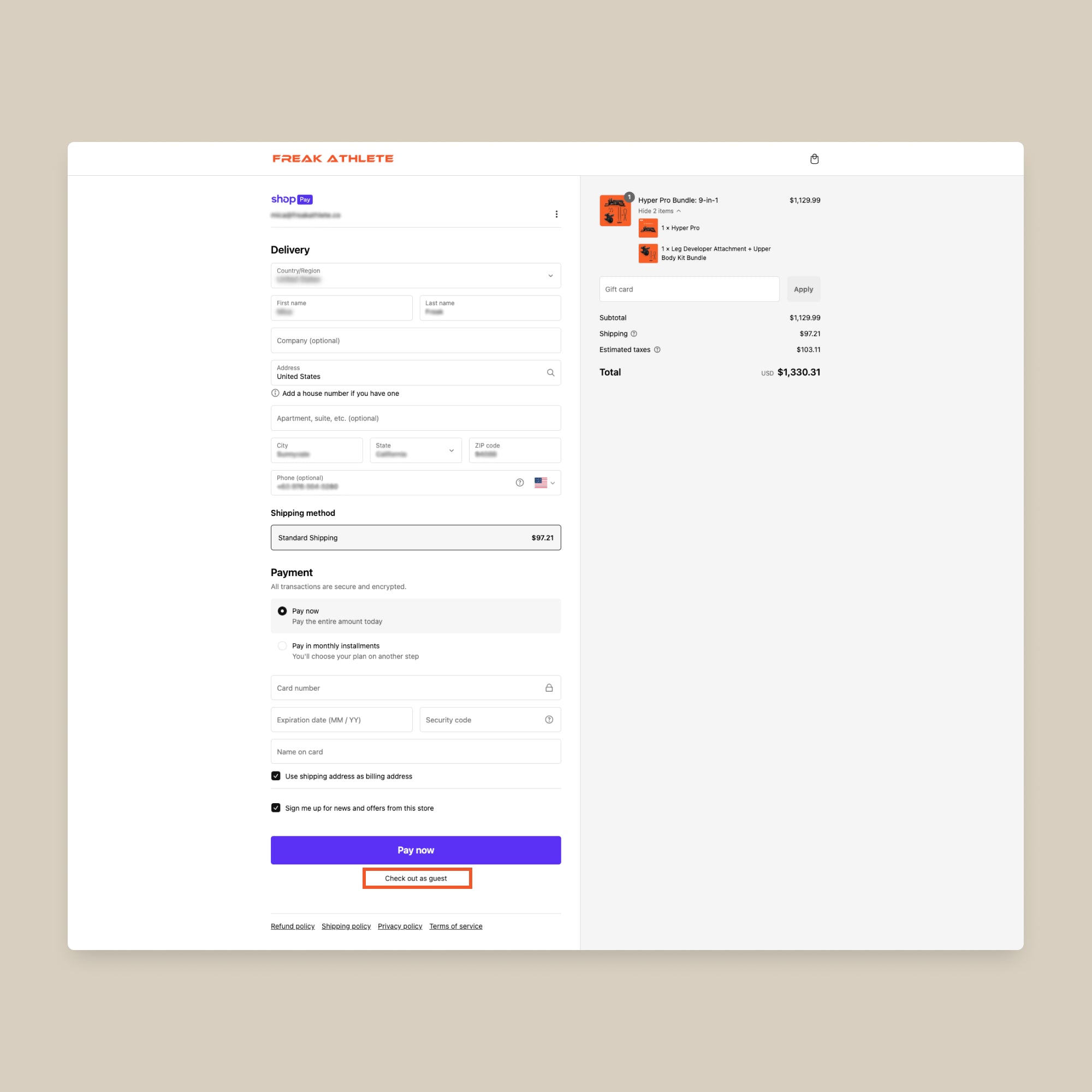

If you're signed in to ShopPay, check out as a guest

If you’re logged into your ShopPay account, make sure to select the “Check Out as a Guest” option. TrueMed payments are not processed through ShopPay, so this step is essential to use your HSA/FSA funds.

STEP 2

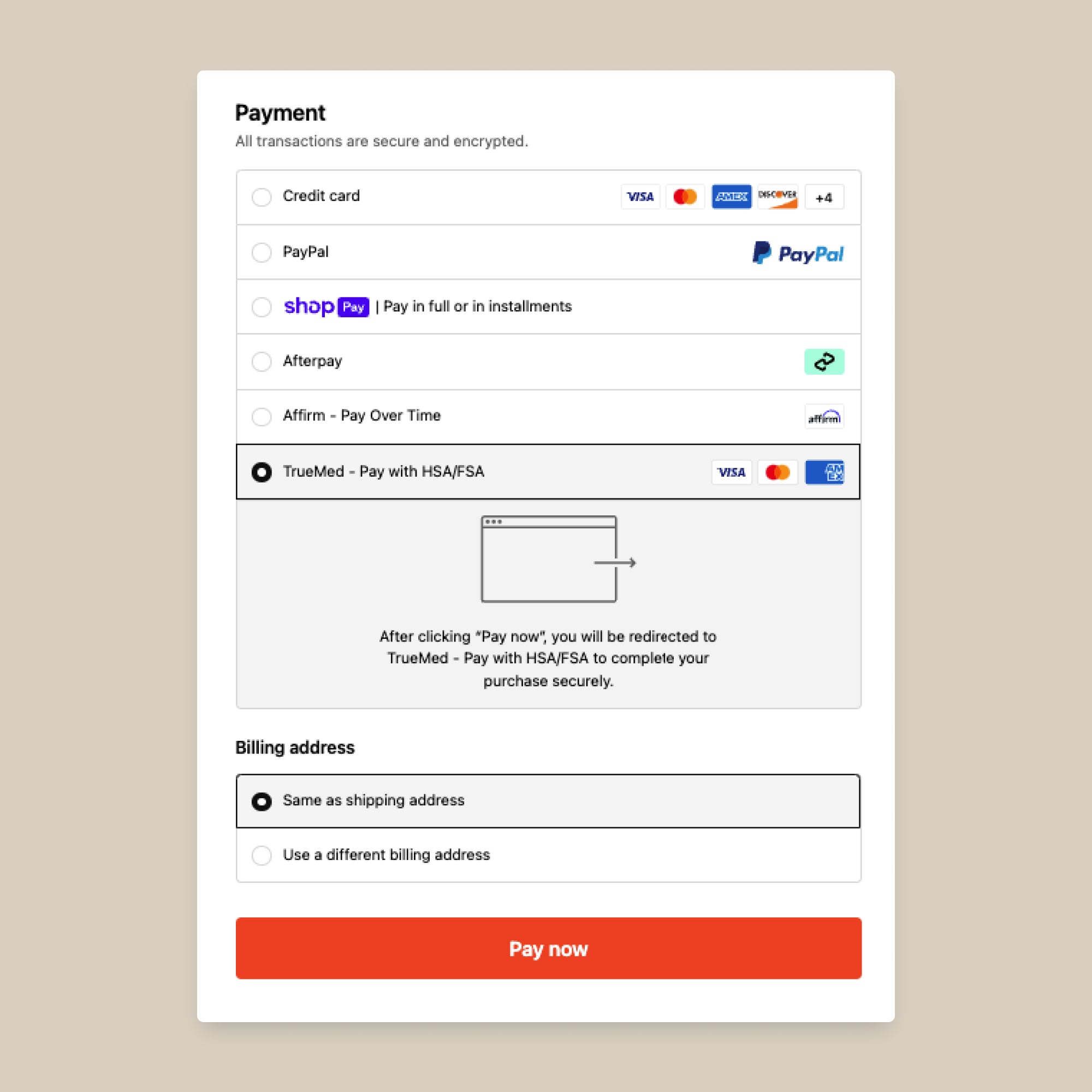

Select TrueMed as your payment method

At checkout, you’ll see an option to pay with “TrueMed - Pay with HSA/FSA”. Choose this option to proceed then click on “Pay now”.

STEP 3

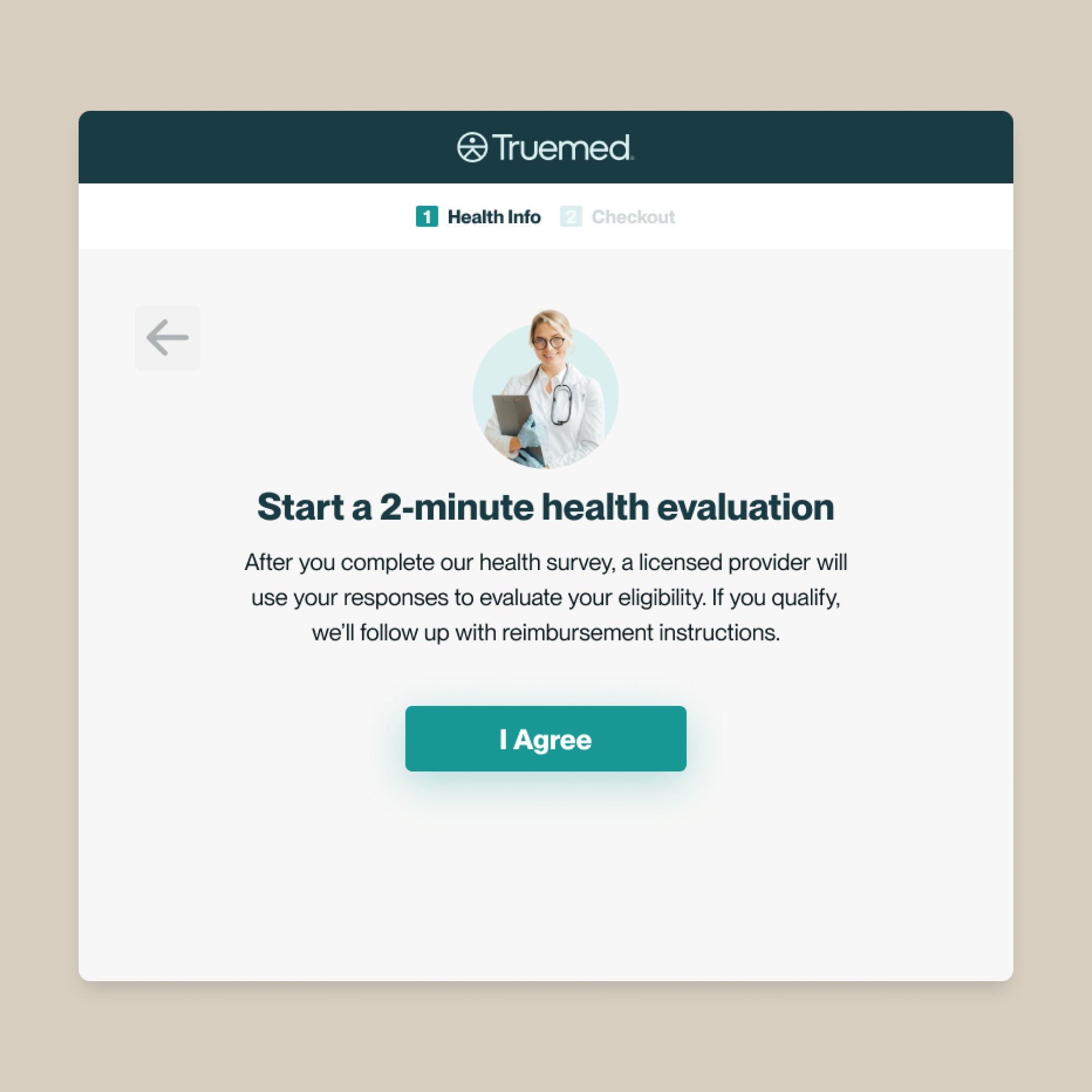

Take a brief health survey

TrueMed will guide you through a short health survey. Answer questions about your HSA/FSA and your health to confirm eligibility for reimbursement.

STEP 4

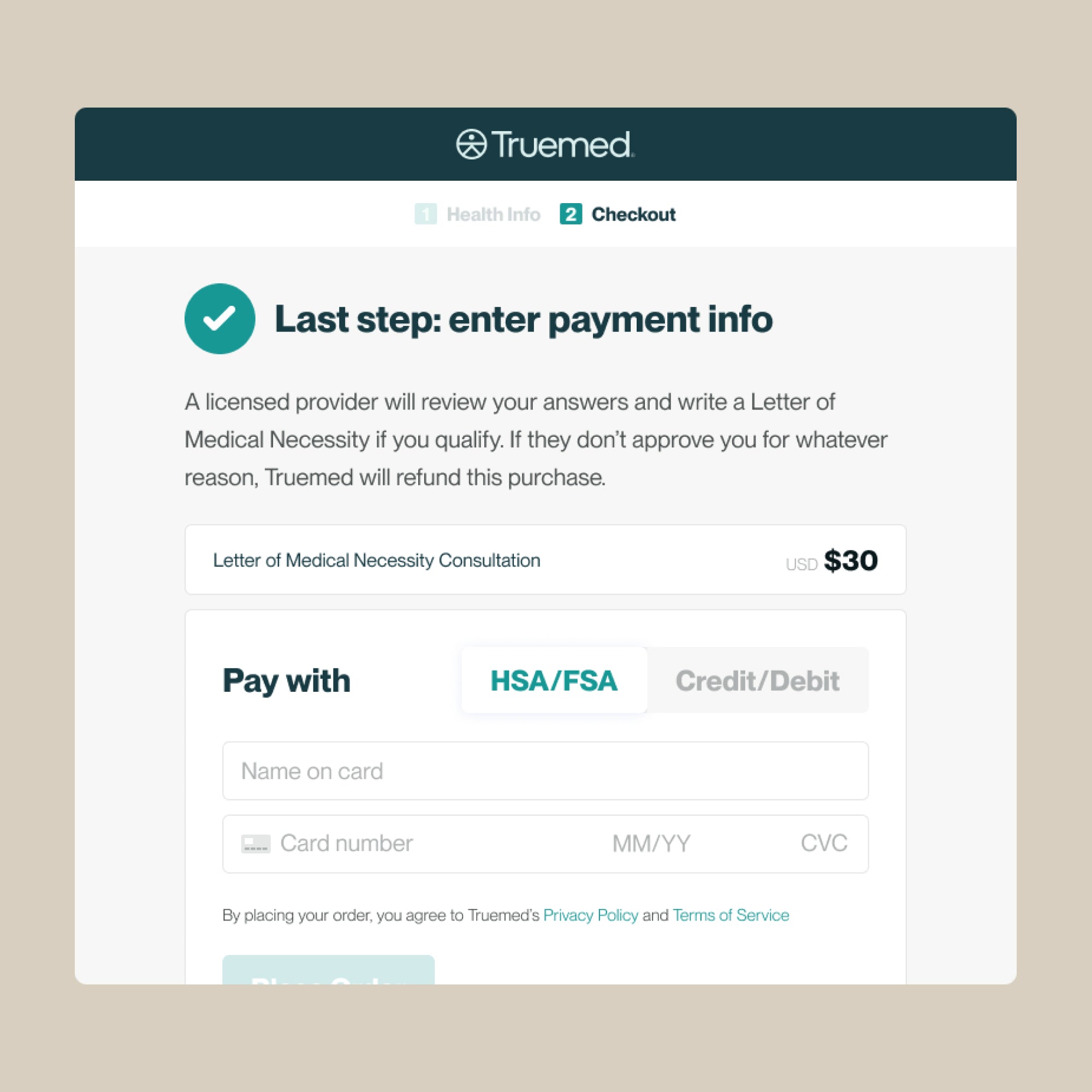

Complete checkout through Truemed

STEP 5

We recommend paying with a credit/debit card, and then reimbursing yourself with HSA/FSA funds after checking out for the best chance of success.

STEP 6

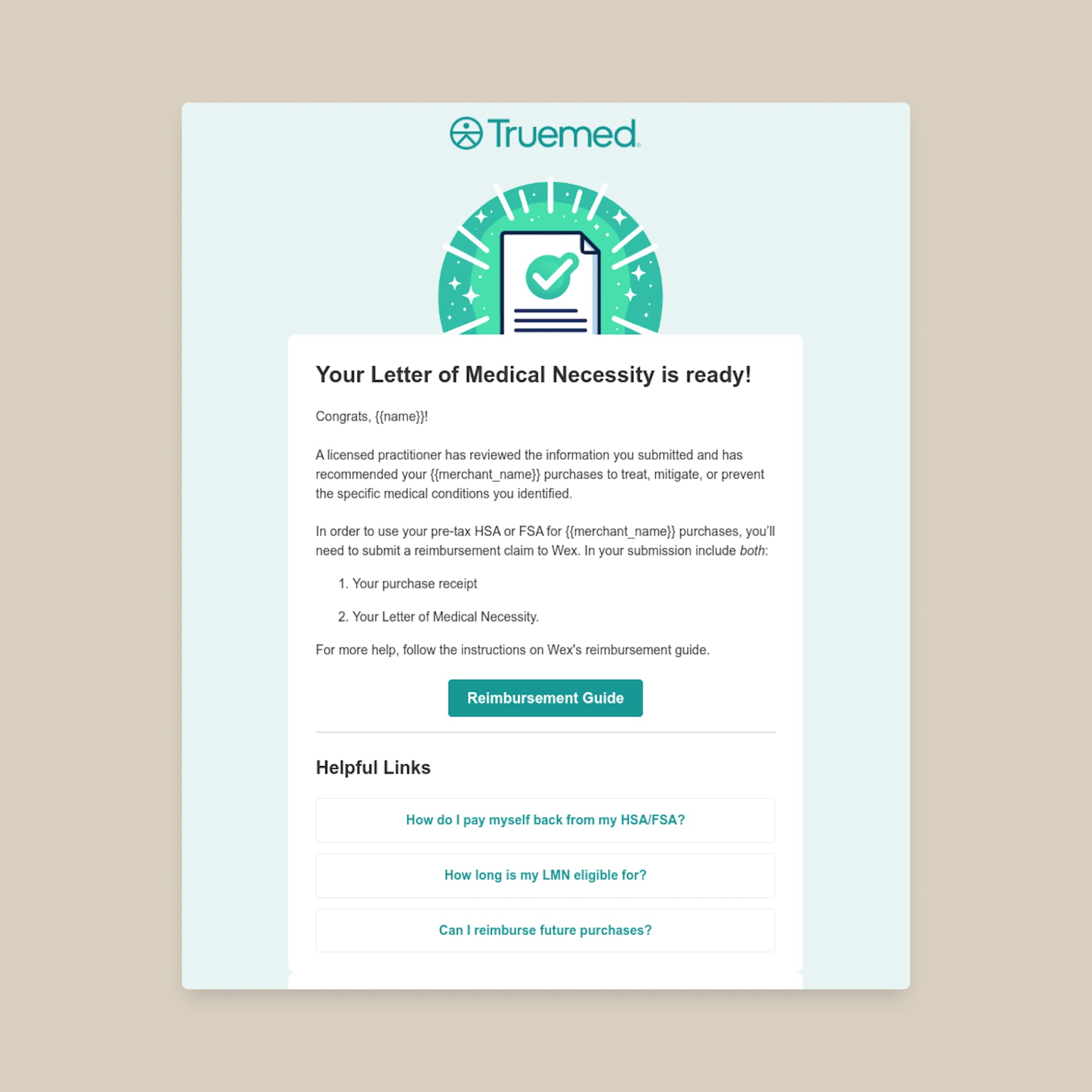

Receive your Letter of Medical Necessity

A licensed medical provider will review your responses and Truemed will send you a Letter of Medical Necessity if you qualify.

How does using my HSA/FSA account save me money?

HSA and FSA accounts were designed to help you invest in your health with pre-tax dollars. That means more buying power for the things that keep you moving, recovering, and performing at your best. Instead of paying taxes on your income first, qualified customers can use pre-tax funds directly to cover eligible health expenses.

Here’s what you can contribute each year:

• Up to $4,150 pre-tax to an HSA for individuals, or $8,300 for families (plus an extra $1,000 if you’re 55 or older).

• Up to $3,200 pre-tax to an FSA, with an additional $500 allowed in employer contributions.

Put those dollars to work for your health—whether you’re building strength, improving mobility, or reducing injury risk. The Hyper Pro is for you.

SHOP HYPER PRO + ATTACHMENTS

Shop with your HSA/FSA

HSAs and FSAs let you use tax-free dollars to invest in products that support your health and performance. With Truemed, you can now easily use these funds on Freak Athlete products like the Hyper Pro to help you move better, bulletproof your body, and perform at your best.

Hyper Pro

$100 off

Bulletproof your Hamstrings, Glutes, Quads, Back, and more with 9 machines in 1. (GHD Attachment now included)

Leg Developer Attachment

Train Leg Extensions, Hamstring Curls, and Upper Body. Upgrade your Hyper into a 9 in 1 machine.

GHD Attachment

Train Leg Extensions, Hamstring Curls, 6+ Upper Body movements, and more.

WheelBarrow Sled

The world's best sled. All surface, heavy duty, and WheelBarrow built in.

Nordic Mini Pro

Bulletproof your hamstrings and protect your knees from home with our portable Nordic Mini Pro.

FAQ

FSA/HSA topics can be confusing, but Truemed makes it easy to use funds you already have.

What are FSA and HSA accounts?

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

Can I use my HSA/ FSA card at Freak Athlete?

While it is possible to do so with Truemed, we do not recommend attempting to checkout with your HSA/FSA cards for compliance purposes. We strongly encourage simply transacting with your normal credit or debit card, and submitting for reimbursement as outlined above for the greatest likelihood of success.

Can I use my regular credit card at checkout

Yes. If you prefer to use your regular credit card, Truemed will send you instructions on how to submit for reimbursement from your HSA//FSA administrator.

What is a Letter of Medical Necessity, and how is this compliant?

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is.

There are thousands of studies showing food and exercise is often the best medicine to prevent and reverse disease. Exercise qualifies as a qualified medical expense with an LMN. Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need. Your Truemed LMN satisfies all IRS requirements to make your wellness spend fully reimbursable.

Are there fees with using Truemed's services?

There is no cost to you, as long as you are shopping with a Truemed partner merchant.

When should I use my FSA/ HSA dollars?

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

Can I use Truemed's services for past purchases?

While this depends on your specific HSA or FSA administrator’s policies, we advise that you only submit expenses incurred on or after the date listed on your Letter of Medical Necessity.

How long does it take for me to receive my Letter of Medical Necessity?

Generally it takes 24-48 hours. In some cases, Truemed’s provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

I don't have an HSA/ FSA. Can I still benefit from Truemed?

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA!

I don't live in the US. Can I still get reimbursed with Truemed?

Unfortunately, Truemed is currently only available in the United States.